CORFIMA B.V.

- +32 3 303 39 30

- info@Corfima.eu

- Duwijckstraat 17 - 2500 LIER - BELGIUM

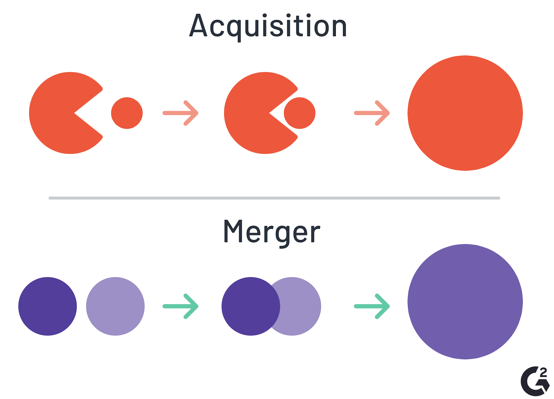

Business transfer in practice

Different phases

The steps to make a succesful acquisition or merger

Phase 1: Introductory meeting

Gathering information on the following:

– Personal/professional motivation

– Family situation

– Timeframe

– Who are the fiduciaries? (notary, accountant, auditor, …)

– What are the objectives after the takeover

– Private tax situation

– Overview of corporate structure

– Potential or desired acquirers?

– How are property and/or real estate involved?

– Idea of the initial form of takeover

– Idea of appreciation and valuation

Estimated time required: 2 hours

Phase 2: Company valuation

Based on historical accounting data, a revaluation of assets & liabilities, and the expected future evolution of the company, a substantiated valuation document is drawn up by using the latest financial modelling techniques. This is an internal document between the transferor and Corfima.

Estimated time required: 1 week

Rates : €2,500 /company

Phase 3: Determination of the company's sales value

Based on the “Valuation of the company” and possible other valuation reports (e.g. real estate, exclusivity contracts, agency, franchising agreement,…), the sales value is determined depending on the availability and the quality of the figures.

Estimated time use: 2 weeks

Phase 4: Presentation file/action plan

Preparation of a presentation file.

On the basis of a structural questionnaire, the transferor collects the data in order to get a complete picture of his company.

– legal form & articles of association

– Activity & history of the company

– corporate culture & structure

– analysis of company data: Balance sheets and P&L statement

– market data on the sector

– customers, suppliers

– staff, management…

– positioning

– expected timing

– form of acquisition (share of asset deal)

– Discussions

On the basis of this information, the consultant draws up a presentation file. This presentation file is used as an introductory document to potential buyers.

Border information :

– Tax consequences (personal and financial (income, assets, etc.))

– transitional period or immediate transfer

– non competition clause & reps & warrants

– which purchasers have preference (optimisation of sales)

– immovable property

Estimated time spent: 3 weeks

Phase 5: Pre-transfer process

Step 1. Swot analysis of own company and industry.

The data from the presentation file are further analysed in order to identify the strengths and weaknesses of the company to be transferred.

The SWOT analysis gives a first indication of the feasibility of the sale as well as the valuation of the company.

Step 2. Determination of the transfer form

Guidance by CorFiMA. If necessary, the services of third parties will be used for this purpose. Fees for lawyers, accountants and tax consultants are charged directly to the transferor, subject to the prior agreement of the transferor to engage these experts.

Step 3 Sale phase: search for an acquirer

Potential acquirer signs a Confidentiality Statement in order to obtain the presentation file and any financial information.

Step 4 Transfer

- Structure of the agreement

- Sale and closing

- Funding

- Binding & suspensive (reps & warrants) conditions, representations and warranties.

Pricing: a percentage on deal value, with deduction of the retainer and other invoiced consulting fees.

Phase 6: Post-acquisition period

If the transferor wishes to remain active for a while.

Set up a construction if the transferor wishes to remain active in the company for a while (1 to 3 years).

Make clear agreements

explore possibilities with social security or other insurance schemes

Planning and management of private assets

The deceased wishes to invest the funds he receives from the sale of his business in order to obtain sufficient means to make a living from it.

Pricing: Takeover consultant hourly rate at 150 euros. Any advice from external advisors will be charged directly, subject to the prior agreement of the transferor.

- Corfima - 2021

- Made with passion by Pixomego.com